Customer Video Testimonial, Los Angeles, CA

Svetlana Brontveyn

Attorney at Law, LLM in Taxation

Svetlana holds a Master of Laws in Taxation (LLM) from Loyola Law School, the highest academic degree in tax law, and a JD from Pepperdine School of Law. She earned her BA from the University of Southern California. Her early experience includes internships with the IRS Office of Chief Counsel and the California Department of Justice, where she developed her expertise in tax law and civil litigation.

With extensive experience in resolving tax controversies at the federal, state, and local levels, Svetlana has successfully represented individuals and businesses nationwide. Her accomplishments include halting bank levies and wage garnishments, securing relief from liens, abatements and more. She excels in complex tax audits, IRS summons proceedings, identity theft investigations, and crafting repayment agreements that help clients manage their tax liabilities without compromising their financial stability. Admitted to practice before the U.S. Tax Court and Federal District Courts, Svetlana has a proven record of success in administrative and civil tax disputes. She has represented clients before the IRS, CA FTB, CA BOE (CDTFA), and EDD, earning a reputation for delivering unmatched results.

Elda is passionate about empowering taxpayers to confidently navigate the complexities of tax resolution. She approaches each case with a unique balance of humility and assertiveness, ensuring clients feel supported and their rights are safeguarded.

Her philosophy is rooted in the belief that every taxpayer deserves respect, compassion, and personalized solutions. She takes pride in simplifying even the most challenging tax issues, breaking them down into clear, actionable steps that bring relief and restore peace of mind. Viewing each case as a partnership, Elda treats every client’s success as if it were her own. She resolves both IRS and state tax problems for busienssess and individuals.

Elda Garza

Enrolled Agent

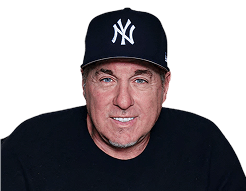

Matt Levy

Founder

Matt Levy, Founder of Ovation Tax Group, brings over 25 years of experience in the tax resolution industry. With deep expertise in IRS processes, Matt is unwavering in his commitment to securing the best outcomes for every client. Known for his tenacity, he is unafraid to challenge the IRS to achieve fair resolutions.

Matt has witnessed the lack of integrity in the tax resolution field and is determined to set Ovation Tax Group apart through transparency, honesty, and unwavering ethical standards. His mission is to provide clients with trustworthy guidance and solutions they can rely on.

With experience spanning all phases of tax and tax relief since 2004, Greg brings a deep well of expertise to his role. His professional background includes over five years as a corporate accountant and auditor, as well as leadership positions as the CEO of both a $30 million tax relief company and a SaaS software company.

Greg earned a Bachelor of Science in Business with a focus on Management Information Systems from the University of Minnesota, followed by a Master of Business Administration in Finance.

Greg is dedicated to building a team that empowers taxpayers to confidently navigate the complexities of the IRS process. His philosophy centers on providing security, protection, and achieving the best possible resolutions for clients’ tax issues, ensuring they experience peace of mind and positive outcomes.

Greg Davis

CEO

Speak With a Real Tax Expert

Start with a 1-on-1 free consultation.

Call the IRS With Us

We’ll do a live 3-way call with the IRS to uncover the truth—right then and there (if your issues are with the IRS). Otherwise, we will call the state on your behalf.

Check If You Qualify

We quickly assess if you’re eligible for relief or reduction programs.

Know the Real Game Plan

We explain exactly what’s happening with your case and how to stop the IRS (or state) in its tracks.

Stop Collections Fast

If collection threats exist, we’ll freeze garnishments, liens, and levies immediately.

You Don’t Pay Unless We Help

If we can't improve your situation, you owe us nothing. That's our promise.

Get the Relief You Deserve

Once qualified, we pursue the lowest possible resolution or most manageable plan available to you if you decide to hire us and agree to our fees.

Speak to a Tax Expert

Share the details of your situation in a free and confidential consultation. We'll also provide representation when communicating with the IRS at no charge to fully evaluate your tax situation and determine the best path forward.

An Honest Assessment

Our tax experts will assess your situation to identify the best solution for your tax challenges. If we can’t help you, we’ll be honest and guide you toward the right resources.

Transparent Quote / Affordable Payments

If we decide to move forward with your case, we’ll provide an upfront quote for our services along with payment options designed to fit your budget.

At Ovation Tax Group, we don’t just want to help you with your taxes—we want to resolve them quickly and completely, so you can get back to living without the constant stress of tax issues.

A Personal Defender for Your Taxes

We’re not just another tax firm. We are your personal defenders—working directly with the IRS and state tax boards, ensuring your situation is resolved with the utmost care and expertise.

Transparency and Integrity

We promise full transparency in every aspect of our work. No hidden fees, no misleading promises. What you see is what you get.

Genuine Commitment

We are committed to helping people, not just signing clients. Our team genuinely cares about solving your problems and improving your financial future.

Fearless Advocacy

We fight hard for our clients—never backing down, always ensuring that your voice is heard.

To make your tax issues less stressful & more manageable for you.

We are a passionate, expert group of tax professionals, ready to jump in to solve even the toughest tax challenges. We approach every case with urgency, care, and integrity.

Ovation Tax Group:

But we’re not just here to fix your problems.

We’re here to give you peace of mind

Help you feel confident about your financial future.

When you work with us, you’re not just getting a service — you’re gaining a team that’s genuinely invested in your success. Whether you’re dealing with the IRS or state tax board, we’ve got your back

Greg Davis

CEO, Ovation Tax Group

Unable to Pay IRS or State Back Taxes

Wage Garnishments & Bank Levy Removal

Release or Remove IRS or State Tax Liens/Warrants

Stop IRS & State Tax Collections & Actions

IRS and State Audit Representation

Delinquent or Missing Yearly Tax Filing

Unpaid or Unfiled Sales or Payroll Tax Obligations

Identity Theft Involving Tax Filings

Civil Tax Penalties and Assessments

A: Tax relief helps reduce your tax liability by negotiating with the IRS or state tax authorities to lower the amount you owe or arrange affordable payment plans. It can assist individuals or businesses struggling with back taxes, penalties, and interest.

A: You may qualify for tax relief if you cannot pay the entire tax amount owed due to financial hardship, have incurred penalties, or are facing aggressive collection actions such as wage garnishments or tax liens. Ovation Tax Group can evaluate your situation and determine the best course of action.

A: Common tax relief programs include offers in compromise, installment agreements, penalty abatement, and currently not collectible status, each designed to reduce or restructure your tax liabilities based on your financial situation.

A: The tax relief process can range from immediate to more than a year to complete. The timeframe depends on the complexity of your case and the type of relief you are seeking. Generally, the more you owe and the greater the reduction you request, the longer the process may take.

A: Yes. Ovation Tax Group is dedicated to helping clients save money by simplifying the complexities of tax laws. Their team of experts work out favorable terms on behalf of clients, which can significantly reduce outstanding tax liabilities. By leveraging their in-depth knowledge and experience, Ovation Tax Group provides substantial savings compared to attempting to manage the process independently

A: Ignoring your back taxes often leads to severe consequences such as wage garnishments, bank levies, tax liens, and damage to your credit. Taking proactive steps with tax relief can help you avoid these penalties and find a manageable solution.

A: Yes. Ovation Tax Group is equipped to manage both federal and state tax situations. Their team is licensed to represent you in every state, ensuring you receive the assistance you need no matter where you live.

A: Absolutely. Ovation Tax Group successfully helps clients find relief from their tax burdens, achieving reductions of up to 90% and, in many cases, settling their liabilities entirely. Through a deep understanding and skilled negotiation of tax law, they work diligently to reach favorable outcomes for those struggling with tax liabilities.

Copyright © 2025: Ovation Tax Group

All Rights Reserved | Privacy Policy | Terms of Use